Top B2B Data Enrichment Tools for 2025

Let’s cut the fluff: If your sales team is still guessing who to pitch or where to find leads, you’re already behind. In 2025, B2B data enrichment isn’t a "nice-to-have"—it’s the engine behind hyper-personalized outreach, razor-sharp targeting, and revenue ops that actually scale. Why? Because 50% of B2B buyers demand tailored experiences from first click to closed deal, and stale data costs companies 30% of potential revenue.

The market’s exploded with tools ranging from billion-contact databases to AI-powered niche hunters. After dissecting 30+ platforms, pricing models, and hidden quirks, here’s your no-BS guide to tools that convert—not just collect dust.

🚀 Market Landscape: Where Data Enrichment Is Headed

Recent acquisitions like HubSpot’s takeover of Clearbit (now "Breeze Intelligence") signal a seismic shift: Data enrichment is now the core of revenue stacks, not a sidecar. The game has evolved from "find more emails" to predicting buyer intent, technographics, and real-time behavioral triggers.

2025’s Unmissable Shifts:

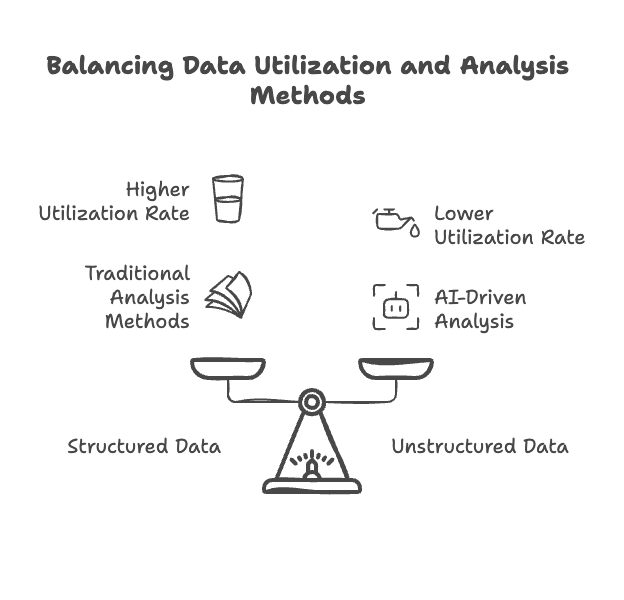

- AI Eats Unstructured Data: Platforms like Artisan’s Ava now analyze social chatter, news trends, and behavioral signals—closing the gap where companies use just 40% of structured data and 31% of unstructured intel.

- Industry-Specific Targeting: Generic tools are obsolete. Store Leads dominates e-commerce with 12M+ store profiles, while Datanyze tracks technographics for SaaS sellers.

- Compliance as a Feature: GDPR/CCPA fines can cripple growth. Tools like Cognism and Lusha bake compliance into their DNA with mobile-verified "Diamond Data" and CCPA-aligned workflows.

- Flywheel > Funnel: Linear sales pipelines are dead. Winners use enriched data to create self-sustaining growth loops where customers fuel referrals and retention.

💡 Pro Tip: Enrichment isn’t hoarding data—it’s filling strategic gaps. Start by reverse-engineering your ICP. Tools like Ocean.io use AI to build lookalike models from your best customers.

🏆 The 2025 Elite: Data Enrichment Tools That Deliver

💼 Enterprise Titans (Budget: $15K+/Year)

Table: Enterprise Tool Comparison

| Tool | Key Strength | Global Weakness | Pricing |

|---|---|---|---|

| ZoomInfo | 300M+ contacts, intent signals | Patchy EU coverage | $14,995+/year |

| Leadspace | "Buyer Graph" ties intent to 200M+ companies | Requires data-ops team | Custom |

| Cognism | GDPR-proof mobile data, AI scoring | Higher cost for behavioral insights | $1.5K–$25K/year |

- ZoomInfo

Dominates with Salesforce/HubSpot integrations and intent data from programmatic ad exchanges. But European SDRs report missing direct dials. - Cognism

The EU’s answer to ZoomInfo: 120M+ European contacts and phone-verified data. Its "Elevate" tier adds Bombora intent signals—ideal for compliance-heavy industries.

🌱 Mid-Market Mavericks ($50–$500/Month)

- Apollo.io

All-in-one prospecting, enrichment, and engagement for $49/user/month. Its database of 275M+ contacts supports 65+ filters (e.g., technographics, funding stage). Downside: Limited to 2,000 CRM exports/month on starter plans. - Clay

Aggregates 100+ data sources (Apollo, Hunter.io) into AI-driven workflows. Its "waterfall enrichment" sequentially checks sources for maximum accuracy. Pricier at $149+/month but unbeatable for cross-platform orchestration. - Artisan

AI artisan "Ava" personalizes outreach using 300M+ lead profiles and behavioral insights. Excels at scaling hyper-relevant email sequences—but lacks third-party reviews as a newer platform.

🎯 Niche Ninjas (Specialized Intel Under $100/Month)

- Crunchbase

Real-time startup funding alerts refreshed daily. The $99/month "Pro" tier is non-negotiable for VCs or sellers targeting emerging tech. - Kaspr

LinkedIn’s secret weapon: Chrome extension pulls emails/phones from profiles, validating against 150+ sources. The free plan includes unlimited email credits—pair it with Sales Navigator for lethal prospecting. - Leadfeeder

IP → company intelligence: Identifies anonymous website visitors and enriches firmographics. Starts at $99/month but costs spike with high traffic volumes.

⚖️ Use Case Matchmaker:E-commerce? Store Leads tracks 12M+ stores.Technographics? Datanyze ($29+/month) reveals tech stacks.API automation? Captain Data builds no-code enrichment workflows.

🔮 Future Trends Explorer

Discover how AI, consolidation, and privacy innovations are reshaping B2B lead enrichment. Click on any trend to explore detailed insights and projections.

Predictive Analytics

AI-powered forecasting using lookalike modeling to predict customer intent and behavior patterns.

Market Consolidation

Strategic acquisitions creating integrated "enrichment ecosystems" for seamless data workflows.

Zero-Party Data

Interactive content enabling prospects to self-enrich through quizzes, calculators, and assessments.

Messaging Intelligence

AI platforms synthesizing customer data to generate hyper-personalized messaging across all channels.

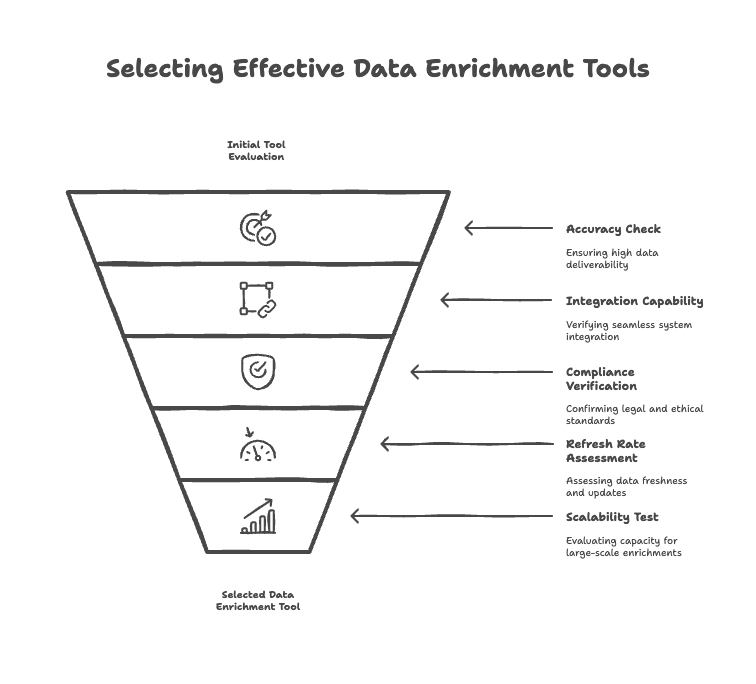

✅ Tool Selection: Brutal-Practical Checklist

- Accuracy Over Volume: Demand phone/email verification (e.g., Cognism’s Diamond Data). Test: Enrich 100 leads—if <90% deliverability, walk away.

- Integration Agility: APIs > closed systems. Must sync with your CRM, email tools, and CDP.

- Compliance Proof: Ask for SOC 2 reports or GDPR processing agreements. Avoid tools scraping LinkedIn without consent.

- Refresh Rates: Real-time (Clearbit, Crunchbase) > weekly batches. Stale data decays 22.5% yearly.

- Scalability: Can it handle 50K+ enrichments/month? Clay and Apollo scale credit limits smoothly.

🛠️ Implementation Hack: Blend automated enrichment with manual spot checks. Use BetterContact ($15/month) for 99.5% email verification pre-campaign.

💥 The Bottom Line

- Enterprise: ZoomInfo for breadth, Cognism for GDPR.

- Mid-Market: Apollo.io for value, Clay for cross-source AI.

- Niche: Crunchbase (startups), Kaspr (LinkedIn), Leadfeeder (visitor tracking).

One truth: Bad data costs more than any tool. Audit quarterly, enrich continuously, and watch your pipeline convert 3x faster.

🔥 FAQ: Quickfire Intel

1. Which tools offer real-time updates in 2025?

Crunchbase (daily), Clearbit (30-day auto-refresh), and TagX (real-time APIs) lead here.

2. Crunchbase vs. Leadspace: startup or enterprise?

Crunchbase = startup/funding intel. Leadspace = enterprise-scale identity resolution. Different beasts.

3. Why’s Kaspr’s Chrome extension a prospecting gem?

It pulls verified emails/phones directly from LinkedIn profiles and validates against 150+ sources.

4. Is Apollo.io cost-effective for CRM updates?

At $49/month with 30+ data points and sales engagement tools? Absolutely.

5. How does Clearbit’s email enrichment differ?

It layers 100+ technographic/firmographic attributes using ML—but verify emails to avoid bounces.

Ready to enrich? Start with our B2B Contact Database guide or explore OSINT tactics for DIY intel.

Data nerd @ GetUser.ai. Been helping sales teams work smarter with data since 2018. I dig into the nuts and bolts of email verification, lead research—the stuff that actually moves the needle.